Difference between revisions of "Goods Receipt"

(→Lines) |

(→Accounting) |

||

| Line 72: | Line 72: | ||

Accounting information related to the material receipt | Accounting information related to the material receipt | ||

| + | For more details please review the accounting article. | ||

| + | |||

| + | A '''"Goods Receipts" can be posted''' if the '''"MaterialMgmtShipmentInOut"''' table is set to Active for accounting in the Active Tables tab of the organization's general ledger configuration. | ||

| + | |||

| + | A "Goods Receipt" posting looks like: | ||

| + | {| class="wikitable" | ||

| + | |- | ||

| + | ! Account !! Debit !! Credit !! Comment | ||

| + | |- | ||

| + | | Product Asset || Receipt Line Cost Amount || Example || Oner per receipt line | ||

| + | |- | ||

| + | | Non-Invoiced Receipts || Example || Receipt Line Cost Amount || Oner per receipt line | ||

| + | |- | ||

| + | | Example || Example || Example || Example | ||

| + | |} | ||

| + | |||

| + | Posting a "Goods Receipt" requires to have the cost of the product/s contained in it calculated. | ||

| + | In the case of a goods receipt that is: | ||

| + | * the purchase price of the product/s | ||

| + | * or the default standard cost of the product/s in case of calculating cost by using an Standard costing algorithm. | ||

| + | |||

| + | If there is no a related purchase order the Costing Server process uses the newer of the following three values: | ||

| + | * the last purchase order price of the receipt's vendor for the product. | ||

| + | * the purchase price list of the product. | ||

| + | * or the default cost of the product. | ||

| + | |||

| + | Moreover: | ||

| + | * The "Legal Entity" organization needs to have a validated Costing Rule configured. | ||

| + | * And the Costing Background Process needs to be scheduled for the Client, therefore it can search and allow that the Costing Server process calculates the cost of the transactions. | ||

| + | |||

| + | Once the costs have been calculated, the '''Goods Receipt can be posted''' to the ledger. | ||

| + | |||

| + | In the case of a receipt containing "Expense" product/s do not having the "Sales" checkbox selected, it is possible to use the product's purchase price instead of the product's cost to post the goods receipt. | ||

| + | |||

| + | This scenario works if the checkbox Book Using Purchase Order Price is selected for the product/s. | ||

| + | In this case it is obviously required that a "Purchase Order" is related to the "Goods Receipt" being posted. | ||

== Landed Cost == | == Landed Cost == | ||

Revision as of 12:30, 24 October 2018

| Back to Procurement Management |

Introduction

A Goods Receipt is a document issued to acknowledge the receipt of the items listed in it. In other words, it is a document used to register in Openbravo the specifics of items physically received in the warehouse.

Normally, the warehouse team is the one in charge of receiving the goods as well as the delivery notes attached to the goods. That's the source of information to take into account while issuing Goods Receipts.

As described in the Costing Server article, the cost of a "Goods Receipt" is calculated based on the related purchase order price of the goods, excluding taxes.

The calculated cost of a "Goods Receipt" is used while posting it to the ledger.

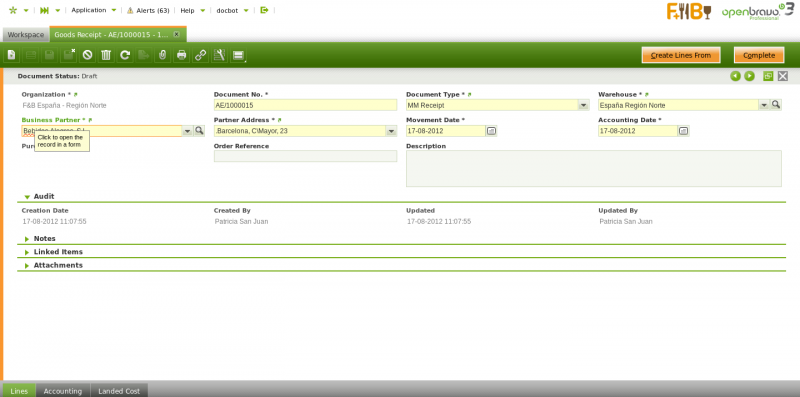

Header

Goods Receipts can be issued and booked in the header section of the goods receipt window.

The fields to fill in the Goods Receipt header are:

- Document Type, which is filled in by default as "MM Receipt"

- Warehouse, where goods are going to be located.

- Business Partner, third party which delivers the goods

- Movement Date, delivery date of the goods

- Accounting Date, accounting date in case of posting the Goods Receipt

- Purchase Order, purchase order number linked automatically by Openbravo, in case the Good Receipt is automatically created from a Purchase Order.

- Order Reference, Warehouse team can fill in here the Supplier's Delivery Note number, this way the internal Good Receipt number and the Supplier's Delivery Note number are linked.

Once header information is properly filled-in, you can then go to the "Lines" tab in order to enter "Goods Receipt Line/s".

To learn how to enter goods receipt lines, visit the next section "Lines".

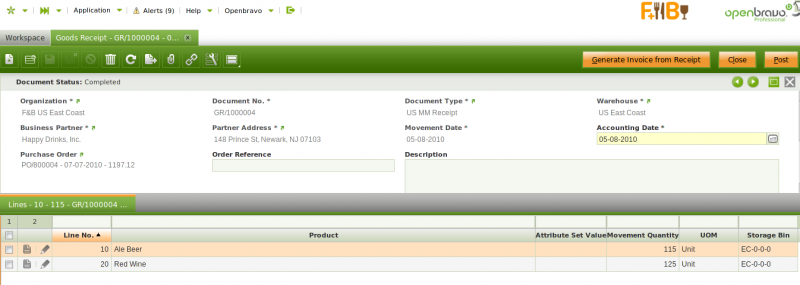

If a "Goods Receipt" is completed and therefore booked:

- the quantity on hand of the item/s received is increased by the quantity received.

If a "Completed" Goods Receipt is voided because the goods have been returned to the supplier for whatever kind of reason:

- the quantity on hand of the items/s returned is decreased by the quantity of the goods returned. Openbravo automatically creates a new "Goods Receipt" for exactly the same items but with "negative" quantities.To learn more about Goods Returns, visit Return to Vendor and Return to Vendor Shipment.

Supplier can send a "Purchase Invoice" together with the "Delivery Note" of the goods delivered, therefore:

- from the Goods Receipt window, it is possible to generate the corresponding supplier's invoice, by using the header process button "Generate Invoice from Receipt".

This action implies a link between the goods receipt and the purchase invoice, procurement management team can be aware of when inquiring the corresponding purchase invoice. To Learn more, visit Purchase Invoice.

Lines

Once the goods receipt header has been properly filled in and saved each item received can be listed as a separate goods receipt line.

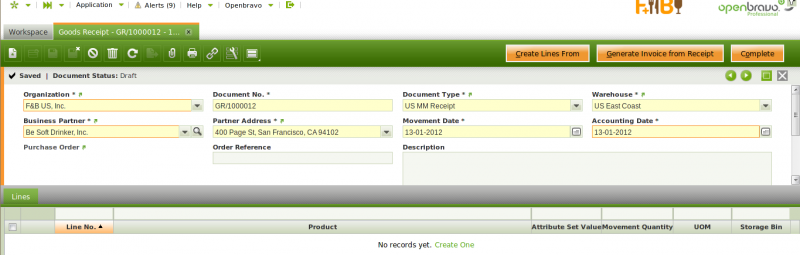

here are several ways of creating goods receipt lines.

1. Warehouse management team can always manually create goods receipt lines. That's the way warehouse management team could use in case there is no a booked purchase order nor a completed purchase invoice for the goods received, they can retrieve data from.

As a consequence of that, the information to manually fill in is:

- the goods or items received

- the quantity received

- and the storage bin where the items are going to be stored

Explode button is shown when selecting a line with a non-stockable BOM product and the product has not already been exploded. When exploding a product, the bill of materials components the selected product consists of are shown in the shipment. Once you have exploded it, you cannot comprime it. You should delete all the lines (first bill of materials components and then the BOM product), and insert again the non-stockable BOM product.

2.- On the other hand, it is also possible to "automatically" create goods receipt lines, by using the header process button "Create Lines From". This way allows warehouse team to the select the orders or invoices pending to be received.

For instance, once a purchase order is selected the purchase order lines pending to be received are shown. Then, the warehouse team is able to select the purchase lines received, change the quantity if required and get them located in a storage bin of a warehouse.

Finally:

- If a purchase order/line is selected, this action links each good receipt line to the corresponding purchase order line, same applies to purchase invoice.

Accounting

Accounting information related to the material receipt

For more details please review the accounting article.

A "Goods Receipts" can be posted if the "MaterialMgmtShipmentInOut" table is set to Active for accounting in the Active Tables tab of the organization's general ledger configuration.

A "Goods Receipt" posting looks like:

| Account | Debit | Credit | Comment |

|---|---|---|---|

| Product Asset | Receipt Line Cost Amount | Example | Oner per receipt line |

| Non-Invoiced Receipts | Example | Receipt Line Cost Amount | Oner per receipt line |

| Example | Example | Example | Example |

Posting a "Goods Receipt" requires to have the cost of the product/s contained in it calculated. In the case of a goods receipt that is:

- the purchase price of the product/s

- or the default standard cost of the product/s in case of calculating cost by using an Standard costing algorithm.

If there is no a related purchase order the Costing Server process uses the newer of the following three values:

- the last purchase order price of the receipt's vendor for the product.

- the purchase price list of the product.

- or the default cost of the product.

Moreover:

- The "Legal Entity" organization needs to have a validated Costing Rule configured.

- And the Costing Background Process needs to be scheduled for the Client, therefore it can search and allow that the Costing Server process calculates the cost of the transactions.

Once the costs have been calculated, the Goods Receipt can be posted to the ledger.

In the case of a receipt containing "Expense" product/s do not having the "Sales" checkbox selected, it is possible to use the product's purchase price instead of the product's cost to post the goods receipt.

This scenario works if the checkbox Book Using Purchase Order Price is selected for the product/s. In this case it is obviously required that a "Purchase Order" is related to the "Goods Receipt" being posted.

Landed Cost

Landed Cost tab allows to allocate additional costs to the goods receipt.

Full list of Goods Receipt window fields and their descriptions is available in the Goods Receipt Screen Reference.

| Back to Procurement Management |