Template:ManualDoc:T800078

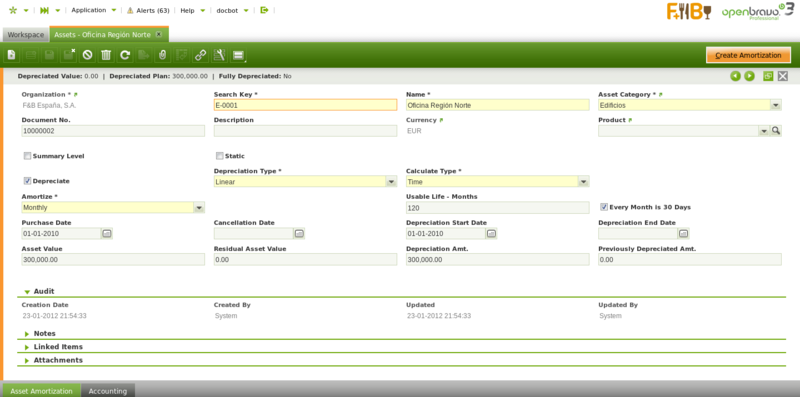

Define assets owned by your company and create an amortization plam for them.

- Organization : Organizational entity within client.

- Search Key : A fast method for finding a particular record.

- Name : A non-unique identifier for a record/document often used as a search tool.

- Asset Category : A classification of assets based on similar characteristics.

- Document No. : An often automatically generated identifier for all documents.

- Description : A space to write additional related information.

- Currency : An accepted medium of monetary exchange that may vary across countries.

- Product : An item produced by a process.

- Summary Level : A means of grouping fields in order to view or hide additional information.

- Static : Prevents from moving the record into the tree

- Depreciate : The asset is used internally and will be depreciated

- Depreciation Type : Depreciation Type

- Calculate Type : Calculate type

- Annual Depreciation % : Depreciation annual %

- Amortize : Asset schedule

- Usable Life - Years : Years of the usable life of the asset

- Usable Life - Months : Months of the usable life of the asset

- Every Month Is 30 Day : When calculating the amortization plan every month will be considered as a 30 day month and years of 365 days (no leap-years).

- Purchase Date : Purchase date

- Cancellation Date : Cancellation date

- Depreciation Start Date : Depreciation Start Date. The amortization plan will be calculated starting from this date.

- Depreciation End Date : Depreciation end date

- Asset Value : Asset value

- Residual Asset Value : Residual asset value amount

- Depreciation Amt. : Depreciation Amount

- Previously Depreciated Amt. : This amount is subtracted to the Depreciation amount when calculating the amortization plan. Total amount to be depreciated = Depreciation Amount - Previously Depreciated Amount

- Depreciated Value : Depreciated value

- Project : Identifier of a project defined within the Project & Service Management module.

- Create Amortization : it will create (or recalculate) the amortization plan based on the asset definition.