Template:ManualDoc:T800165

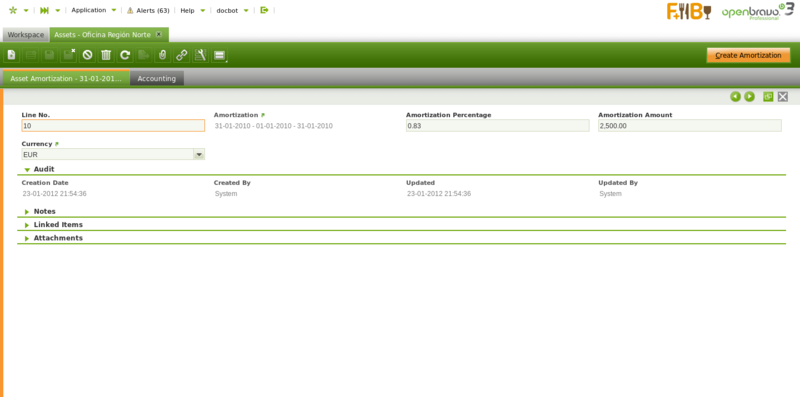

- Line No. : A line stating the position of this request in the document.

- Amortization : The depreciation or reduction of a product value over time.

- Amortization Percentage : Amortization Percentage

- Amortization Amount : Amortization Amount

- Currency : An accepted medium of monetary exchange that may vary across countries.

The Create Amortization process populates the Asset Amortization tab.

The Asset Amortization tab shows the depreciation plan of the asset based on its usable life time and its value that is the amount to be depreciated. The asset value is split within its usable life (months or years), therefore each depreciation plan line represents a percentage of the total depreciation amount of the asset.

It is important to remark that the proposed depreciation plan lines can be manually removed whenever they are not processed and posted. In that case the create amortization process can be executed once again, therefore the depreciation plan is recalculated. This is very useful in those cases where the value of an asset changes or the usable life time of an asset changes once its depreciation has started.

There is a restriction though, when removing lines, if the user plans to click the Recalculate Amortization button afterwards. The lines must be removed always starting from the latest one and without leaving undeleted lines in between. For example, having amortization lines such as:

- Line 10 - January depreciation plan line

- Line 20 - February depreciation plan line

- Line 30 - March depreciation plan line

You cannot remove the depreciation line of February until you remove the depreciation line of March.

The process assumes that if the March depreciation line exists, then the February depreciation line exists.