Template:ManualDoc:T1002100010

Revision as of 08:37, 18 November 2021 by Wikiadmin (talk | contribs) (Created page with "900px As shown in the image above, each tax rate selected needs also to be linked to a document type.<br> Therefore, it is not onl...")

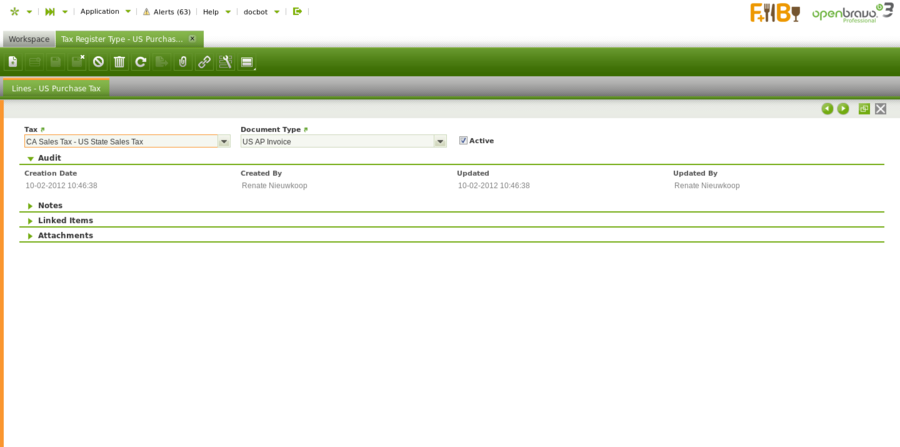

As shown in the image above, each tax rate selected needs also to be linked to a document type.

Therefore, it is not only possible to configure the tax rates which will be taken by the tax payment process as part of a tax register type but also the document types which will be taken into account.

Sales document types which can be linked to the corresponding sales tax are:

- AR Invoice

- AR Credit Note

- Reversed Sales Invoice

- ES Return Material Sales Invoice

Purchase document types which can be linked to the corresponding sales tax are:

- AP Invoice

- AP Credit Note

- Reversed Purchase Invoice