Template:ManualDoc:T800236

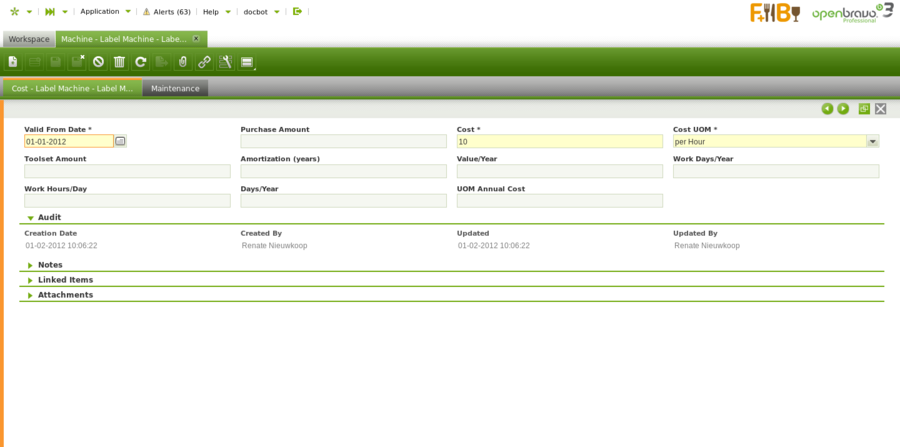

In the Cost tab, all cost and amortization information is entered:

- Valid from Date: start date for the amortization

- Purchase Amount: the amount that is paid for the machine

- Cost: cost per UOM automatically populated after the above information about the machine is filled out, based on the calculation: Value/Year / UOM Annual Cost. In the above example this is 3750 / 2350 = 1.60.

- Cost UOM: indication of how the cost should be calculated, per hour, per produced units, etc.

- Toolset Amount: extra amount for the machine, for example for components

- Amortization: number of years in which the amortization for the machine will take place

- Value/Year: amortization amount per year, based on the calculation: (Purchase Amount + Toolset Amount) / Amortization. In the above example this is (10,000 + 5,000) / 4 = 15,000 / 4 = 3,750. The value is populated when the amount of year of amortization is entered.

- Work Days/Year: amount of days per year that the machine is used

- Work Hours/Day: number of hours per day that the machine is used

- Idle Time/Year: number of hours that the machine is not working in a year, for example because it is in maintenance.

- UOM Annual Cost: Populated field based on the calculation: (Work Days/Year x Work Hours/Day) - Idle Time/Year. In the above example this is (300 x 8) - 50 = 2400 - 50 = 2350.