Payment Method

| Back to Financial Management |

Contents

Introduction

Payment Methods represent means of payment employed by your enterprise or by a business partner, such as:

- Cash

- Credit Card

- PayPal

- Cheque

- Direct Debit

- Standing Order

- Bank Transfer

- Note Payable

Payment Methods are associated to Financial Account. It is possible to associate multiple Payment Methods to a single Financial Account. For example, both checking and electronic payments may have a single Financial Account.

Payment Method

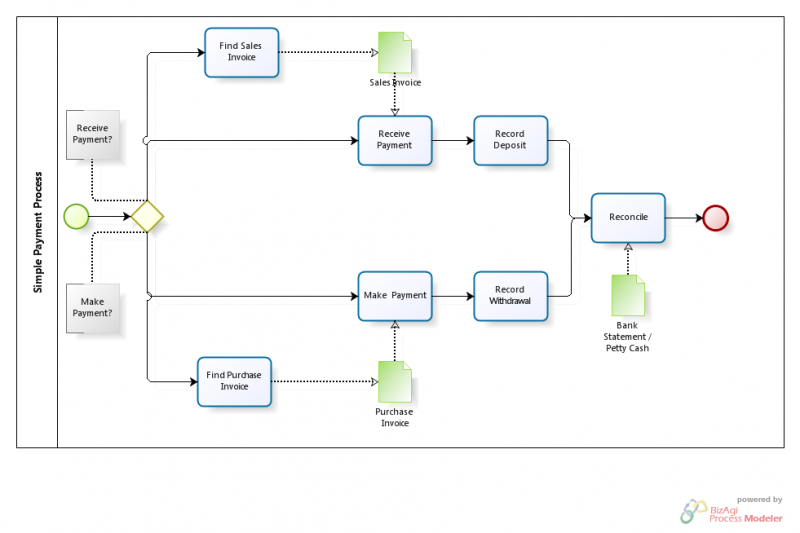

To understand the configuration of the Payment Method, it is necessary to understand the Payment Status Flow related. In the image below, a Simple Payment Workflow is shown:

In the diagram below and following explanation, the different Payment Statuses are explained.

During the whole Payment Process, the payment will be defined by one status so the user knows the last step of the process taken place and the following step that should take place:

- Awaiting Payment: This status takes place when the Invoice has been completed but the payment has not been entered yet.

- Awaiting Execution: (optional status) This status takes place when the Payment/Receipt has been added and there is an automated execution process to be executed (In case that the Payment Method is Manual, this status will be skipped, for example when for cash over the counter transactions).

- Payment made/received: This status takes place when the Payment has been completed and processed.

- Withdrawn/Deposited not Cleared: This status takes place when the payment has been added to the Financial Account screen.

- Payment Cleared: This status takes place when the Payment reconciliation has been executed via Payment Execution.

Accounting Transactions

During this Payment Status Flow , posting to the General Ledger can take place if configured for it:

- When Payment is processed through the Payment In or Payment Out screen

- When Payment transaction is added in the Transaction tab of the Financial Account

- When Payment is cleared in the Transaction tab of the Financial Account

The different accounts that will be used for the posting can be configured in the Payment Method window (see below).

Payment Method

In the image below a snapshot of the Payment Method tab is shown. This is the main tab where the Payment Method is configured. There are several options to configure the default workflow of each Payment Method, this options are be explained below.

Note: These options are the defaults for this Payment Method. Each Financial Account also allows workflow options to be defined. Any variation in workflow associated with a Financial Account takes precedent over the default workflow.

Defaults Payment IN

- Payment In Allowed: If checked, the Payment Method is enabled to receive payments, so it will be shown in Sales Invoice to be chosen.

- Automatic Receipt: If checked, on completion of a Sales Invoice the payment is automatically received. (For example for cash over the counter transactions).

- Receive Payments in Other Currencies: If checked, it’s possible to receive payments in other currencies than the Financial Account default currency. ( Note: "System" conversion rate for a given date is used unless it is manually updated by the end-user).

- Automatic Deposit: If checked, the payment is automatically Deposited in the Financial Account configured when Processing the Invoice. (For example for credit card receipts)

- Execution Type

- Manual: Reception of payment is a manual event. For example, payment by cash.

- Automatic: The reception of payment will be automated by the system when launching a process to support receipt. (For example a credit card interface being launched to record a receipt of payment).

- Execution Process: Select the process to be launched to automate the receipt.

- Deferred: If checked, it prevents the system to kick off the execution process automatically.

- Upon Receipt Use: Account to be used upon Receipt. Would normally be either left blank (if financial transaction is to be created later in the workflow), an In-transit Payment Account or a Financial Account.

- Upon Deposit Use: Account to be used upon Deposit. Would normally be left blank (if no financial transaction required for the Deposit event) or a Deposited Payment Account.

- Upon Reconciliation Use: Account to be used upon Clearing. Would normally be the Financial Account, but could be left blank if the receipt has been posted to the Financial Account earlier in the process (perhaps upon receipt or upon deposit).

Defaults Payment OUT

- Payment Out Allowed: If checked then the Payment Method is enabled to make payments, so it will be shown in Purchase Invoice to be chosen.

- Automatic Payment: On completion of a Purchase Invoice the payment is automatically made. (For example for cash over the counter transactions).

- Make Payments in Other Currencies: If checked, it’s possible to make payments in other currencies than the Financial Account default currency. ( Note: "System" conversion rate for a given date is used unless it is manually updated by the end-user.)

- Automatic Withdrawal: If checked, the payment is automatically withdrawn in the Financial Account. (For example for credit card receipts).

- Execution Type

- Manual: Creation of a payment is a manual event. For example, payment by cash.

- Automatic: The payment will be automated by the system when launching a process to support payment. (For example a credit card interface being launched to make payments).

- Execution Process: Select the process to be launched to automate the payment process.

- Deferred: If checked, it prevents the system to kick off the execution process automatically.

- Upon Payment Use: Account to be used upon payment. Would normally be either left blank (if financial transaction is to be created later in the workflow), an Intransit Payment Account or a Financial Account

- Upon Withdrawal Use: Account to be used upon withdrawal. Would normally be left blank (if no financial transaction required for the Withdrawal event) or a Withdrawn Payment Account

- Upon Reconciliation Use: Account to be used upon clearing. Would normally be the Financial Account, but could be left blank if the receipt has been posted to the Financial Account earlier in the process (perhaps upon payment or upon withdrawal).

Note: Automatic Receipt and Automatic Payment require a Financial Account to be associated with the Business Partner.

Full list of Payment Method window fields and their descriptions is available in the Payment Method Screen Reference.

| Back to Financial Management |