Template:ManualDoc:T129

A Fiscal Year is an accounting year which normally includes the twelve consecutive months over which a company determines earnings and profits.

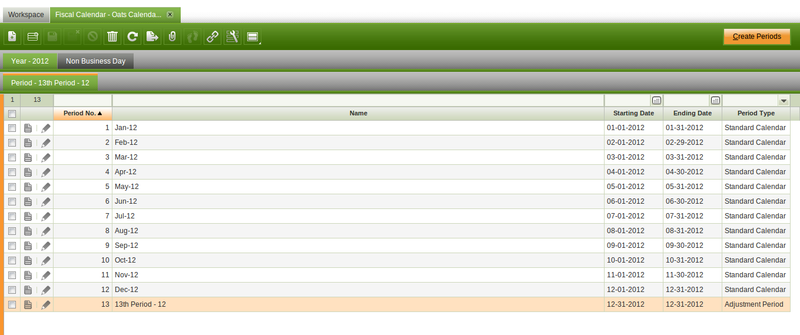

The button "Create Periods" allows to create the twelve consecutive months starting from "January, 1st" to "December, 31st" as "Standard Calendar Period" Types.

This process also allows to create the "13th Period" which is a period that can be used to make accounting adjustments and get them posted to the ledger by using G/L Journals.

The "13th Period" is an "Adjustment Period" that is the last date of the last standard calendar period (i.e 31-12-2012).

Once created all the periods need to be opened in the Open/Close Period Control window.

The periods of an organization's fiscal calendar can be reviewed in the Period Control tab of the Organization windows. Note that:

- "Standard Calendar Periods" are opened for every "Document Category", which means that Openbravo obviously allows to post any document type to the ledger within a standard calendar period opened.

- while the "Adjustment Period" is only opened for G/L Journal document category, which means that Openbravo allows to post only G/L journals within the adjustment period.

Additionally it is possible to manually create the accounting periods of a year. That action requires to enter below data:

- a consecutive period number: this number will be later on used to open/close consequent accounting periods at a time.

- a period name

- the starting date of the period

- the ending date of the period

- and the period type as "Standard Calendar Period Type" or "Adjustment Period" as required.

The values of a Period can be manually modified also, but only while this Period is in a Never Opened Status, once it has been open it will not longer be possible.

Openbravo checks if another period with the same starting and ending date is already registered in the system and it does also checks if the date of a period overlaps the date of another period.

Finally, a year can be:

- "closed"

- and re-opened

Both actions are performed in the End Year Close window