Difference between revisions of "G/L Item"

(Created page with "{{BackTo|Financial Management}} === '''Introduction''' === A G/L item is an account item to be used for direct account posting. Direct account posting refers to: * entering...") |

|||

| (One intermediate revision by the same user not shown) | |||

| Line 1: | Line 1: | ||

{{BackTo|Financial Management}} | {{BackTo|Financial Management}} | ||

| − | + | == '''Introduction''' == | |

A G/L item is an account item to be used for direct account posting. | A G/L item is an account item to be used for direct account posting. | ||

| Line 10: | Line 10: | ||

* or creating and posting G/L item payments in a GL Journal. | * or creating and posting G/L item payments in a GL Journal. | ||

| + | == '''G/L Item''' == | ||

| − | |||

G/L Item window allows to create as many account items as required for an organization and general ledger. | G/L Item window allows to create as many account items as required for an organization and general ledger. | ||

| Line 24: | Line 24: | ||

| − | + | == '''Accounting''' == | |

Account items are directly related to the debit and credit accounts to be used while posting them. | Account items are directly related to the debit and credit accounts to be used while posting them. | ||

Latest revision as of 15:52, 26 October 2018

| Back to Financial Management |

Introduction

A G/L item is an account item to be used for direct account posting.

Direct account posting refers to:

- entering and posting accounting entries in a G/L Journal by using the corresponding GL items and therefore their debit/credit accounts defined.

- creating and posting financial invoices such as Purchase Financial invoices, same applies to sales.

- or creating and posting G/L item payments in a GL Journal.

G/L Item

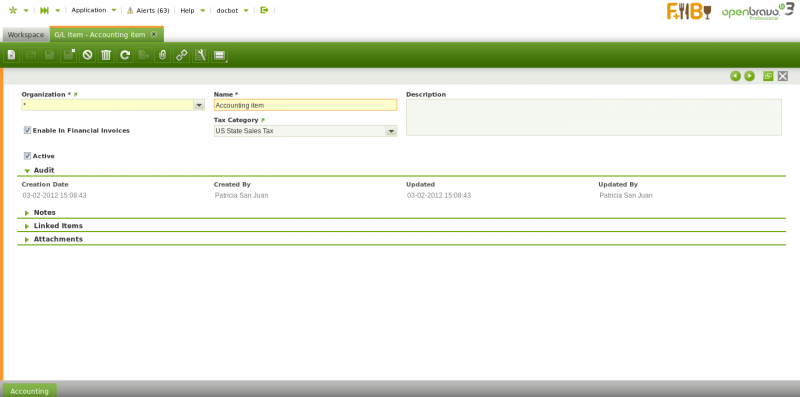

G/L Item window allows to create as many account items as required for an organization and general ledger.

As shown in the image above a G/L item or accounting item can be created by entering below listed basic information:

- the Organization, as always if a G/L item is created at (*) organization level will be shared accross all the organization of the client.

- the Name of the item

- the flag "Enable in Financial Invoices" define if the item can be used as an account while creating and posting financial sales and purchase invoices, if that is the case:

- a Tax Category will have to be selected to get that purchase or sales taxes are properly calculated.

Accounting

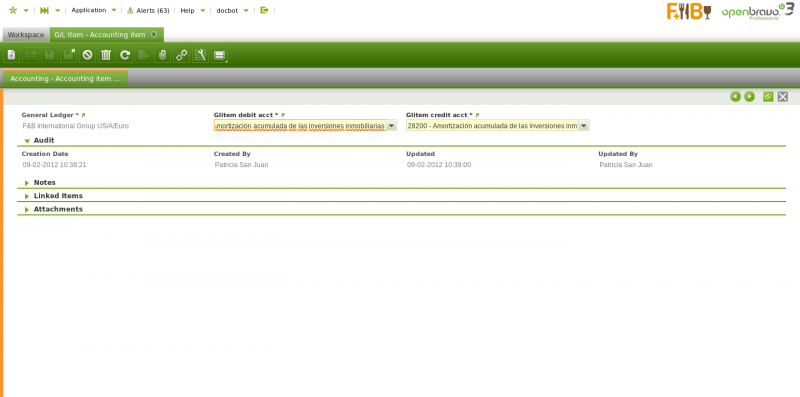

Account items are directly related to the debit and credit accounts to be used while posting them.

As shown in the image above, the accounting tab allows to enter debit and credit accounts for the G/L item. It is possible to enter a debit and a credit account for each organization's general ledger configuration.

Full list of G/L Item window fields and their descriptions is available in the G/L Item Screen Reference.

| Back to Financial Management |