Fiscal Calendar

| Back to Financial Management |

Contents

Introduction

"Legal entities with accounting" organization types must have a fiscal calendar assigned while rest of organization types can inherit it from its parent.

A calendar contains years and the periods of each year required to get an accurate organization's accounting practice.

.

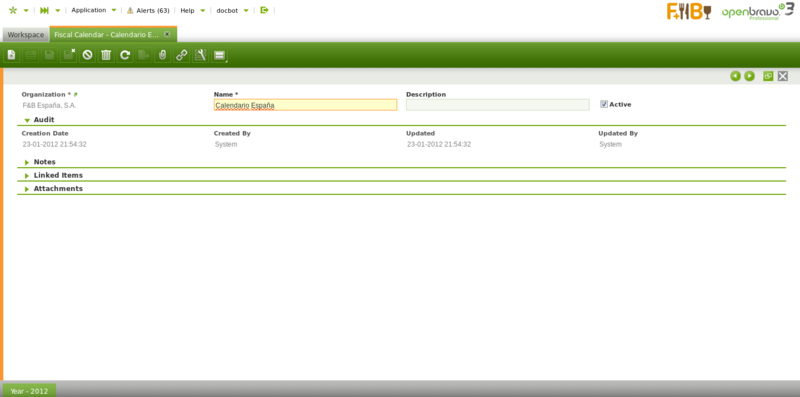

Calendar

The fiscal calendar window allows to create and maintain the organization's fiscal calendar.

A fiscal calendar is a collection of years to be created on demand as time goes by.

Each organization requiring a calendar needs to have one calendar assigned to it and only one therefore it is clearly know which calendar is going to be used while posting transactions and while opening and closing the accounting cycle. The way to get that working is:

- once the calendar is properly created in this window, it needs to be linked to the "legal with accounting organization" type by selecting it after enabling the checkbox "Allow Period Control".

All of the above is done in the Organization window.

Openbravo automatically proposes the organization as * while creating a fiscal calendar:

- accepting this default means that this calendar will be maintained at the client level and will therefore be available to all other organizations created within this client.

- changing this default to other organization means that this calendar will only be available to that organization.

Year

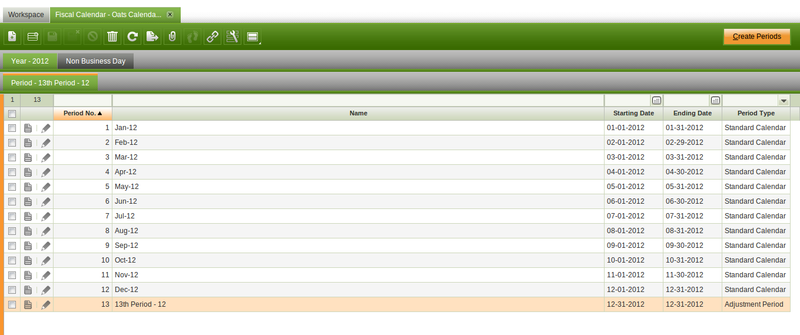

Year tab allows to create as many fiscal years as required within a fiscal calendar.

A Fiscal Year is an accounting year which normally includes the twelve consecutive months over which a company determines earnings and profits.

The button "Create Periods" allows to create the twelve consecutive months starting from "January, 1st" to "December, 31st" as "Standard Calendar Period" Types.

This process also allows to create the "13th Period" which is a period that can be used to make accounting adjustments and get them posted to the ledger by using G/L Journals.

The "13th Period" is an "Adjustment Period" that is the last date of the last standard calendar period (i.e 31-12-2012).

Once created all the periods need to be opened in the Open/Close Period Control window.

The periods of an organization's fiscal calendar can be reviewed in the Period Control tab of the Organization windows. Note that:

- "Standard Calendar Periods" are opened for every "Document Category", which means that Openbravo obviously allows to post any document type to the ledger within a standard calendar period opened.

- while the "Adjustment Period" is only opened for G/L Journal document category, which means that Openbravo allows to post only G/L journals within the adjustment period.

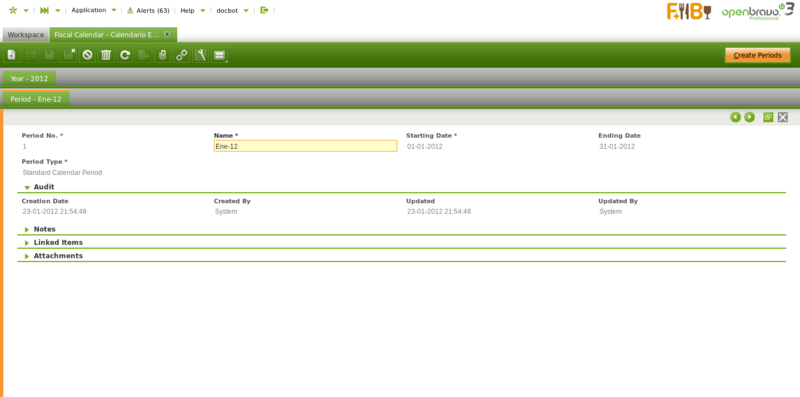

Additionally it is possible to manually create the accounting periods of a year. That action requires to enter below data:

- a consecutive period number: this number will be later on used to open/close consequent accounting periods at a time.

- a period name

- the starting date of the period

- the ending date of the period

- and the period type as "Standard Calendar Period Type" or "Adjustment Period" as required.

The values of a Period can be manually modified also, but only while this Period is in a Never Opened Status, once it has been open it will not longer be possible.

Openbravo checks if another period with the same starting and ending date is already registered in the system and it does also checks if the date of a period overlaps the date of another period.

Finally, a year can be:

- "closed"

- and re-opened

Both actions are performed in the End Year Close window

Period

The period tab lists all the periods of a year.

Full list of Fiscal Calendar window fields and their descriptions is available in the Fiscal Calendar Screen Reference.

| Back to Financial Management |