Difference between revisions of "How to Set Up Discounts for Early Payment"

(→Results) |

|||

| Line 131: | Line 131: | ||

* early payment discount has been accounted separately | * early payment discount has been accounted separately | ||

| − | [[Category: | + | [[Category:HowTo_Process]] |

Latest revision as of 06:26, 20 December 2021

Contents

Objective

Early payment discount is used by companies as a gesture of acknowledge a payment received before it comes due.

In other words an early payment discount agreed upon the parties means a financial discount for the customer, because:

- the sales amount is issued in "Gross" amounts, based on the corresponding Price List

- the discount is applied to the total amount of the invoice excluding taxes, and it is accounted separately

Above means that this type of discounts are shown as a separate item reducing Sales in the P&L report of the company.

If instead of using an early payment discount, a price offer (or lower price) is used, then the sales order is issued net of the discount.

Therefore, the main difference between these two ways of reducing sales is the way those are represented in the P&L report of the company:

- early payment discounts are shown as a separate item (gross sales amounts less discounts)

- whereas price adjustments sales are shown net of discounts

Early Payment Discounts can apply to both, Sales and Purchase:

- an early payment discount in purchase implies a reduction in the amount to pay to the vendor (less expense)

- an early payment discount in sales implies a reduction in the amount to receive from the customer (less income).

Early payment discount can be of many types, for instance:

- 1/5 net 30 - this means that the invoice must be paid in 30 days, but if it is paid in 5 days a 1% discount will be applied.

- 1/5 EOM - this means that a 1% discount will be applied if the invoice is paid in the first 5 days of the next month.

- etc.

It is important to remark the way early payment discounts work in Openbravo:

- this type of discounts are not calculated once the invoice has been paid as agreed but while issuing the invoice, therefore this type of discounts are included in the invoice

- if afterwards the customer does not pay in advance, it will be necessary to modify the issued invoice manually by removing the discount.

- this type of discounts are included in the invoice once agreed upon the parties regardless the "Payment Terms" previously agreed.

Recommended articles

Managing early payment discounts requires a clear understanding on how to create a Discount and how to issue a Sales Invoice.

Execution steps

In Openbravo, the company in this example requires to manage a 10% early payment discount as the customer has commited to pay a sales invoice before its due date, that means in the next 5 days.

To get that working, the company in this example needs to:

- create a "Discount" Product as the way to get the proper discount accounting.

- The reason why is because this type of discounts are reflected as a separate item in the sales invoice and in the sales invoice accounting

- create the agreed Discount

- assign that discount to the Bussines Partner

- and finally issue a Sales Invoice to the Business Partner.

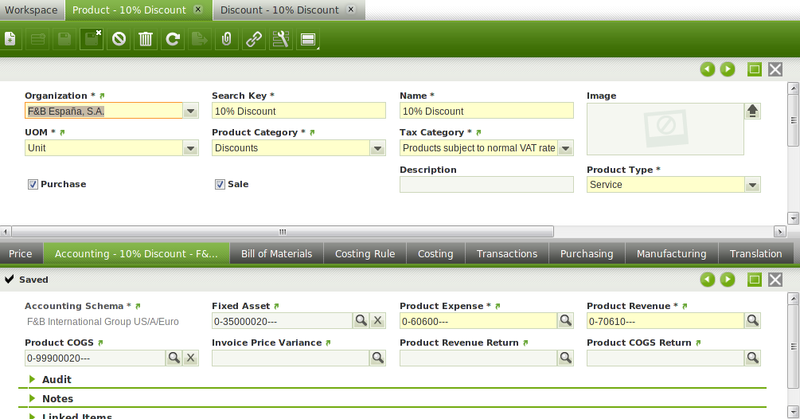

Creation of the "discount" product

Products are created and maintained in the Product window.

Product window contains multiple product related information, but only few basic data is required to be filled in the Header and in the Accounting tab of the Product window.

Header tab:

- the name of the product, for instance "10 % Discount".

- the Product Category, for instance "Discounts" as it may be useful to create a specif product category to include this type of discounts.

Accounting tab:

- the Product Expense account, that is the ledger account needed to post early payment discounts on purchase transactions

- the Product Revenue account, that is the ledger accont needed to post early payment discounts on sales transactions

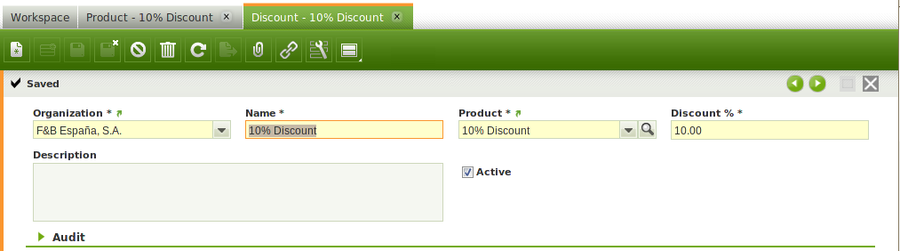

Creation of an Early Payment Discount

Discounts are created and maintained in the Discounts window.

The fields to fill in there are:

- the Name of the discount, that is the name shown if the invoice is printed

- the "Discount" Product previously created

- and the Discount %

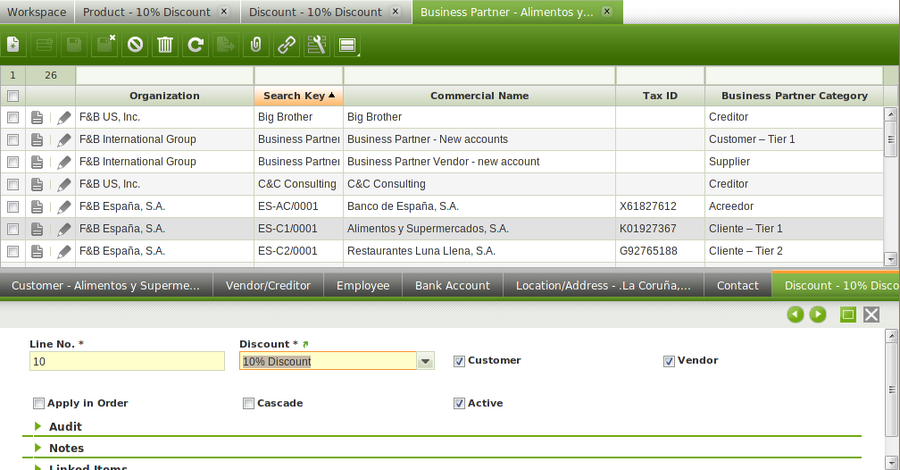

Business Partners set up

Business partners are created and maintained in the Business Partner window.

The company in this example will have to complete business partner data by entering discount information in the Discount tab of the business partner window:

As shown in the image below, the data to fill in here are:

- the Discount previously created

- and the "Customer" checkbox must be selected as the discount is going to be applied to a Business Partner set as "Customer".

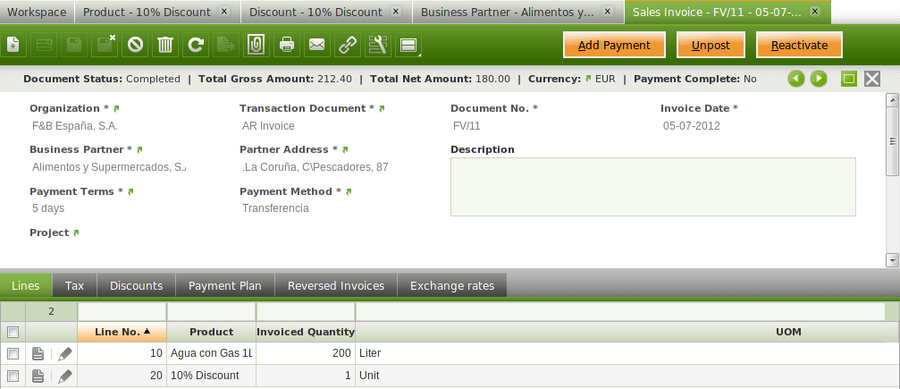

Sales Invoice creation

The next step is to create a sales invoice.

It is important to check that the configured early payment discount has been automatically included in the Discount Tab of the sales invoice once the invoice has been completed.

Then a new line is included in the Invoice Line Tab. That line is the discount Line which won’t be shown in the Invoice Form.

| When developing a new Invoice form, isDiscount column on c_invoiceline table will differ both line types. Make sure your form includes Discounts on it development. |

As shown in the image above:

- the original total amount excluding taxes is 200,00

- once the invoice is completed a 10% Early Payment Discount is calculated

- therefore the new "Total Net Amount" is 180 EUR (200,00 - 20,00)

- once the discount is applied the "Total Gross Amount" is equal to 212,40 ("Total Net Amount" + 18% Taxes )

From an accounting point of view:

| Account | Debit | Credit |

| Customer Receivable | Total Gross Amount 212,40 |

|

| Discount Product Revenue | Discount Amount 20 |

|

| Product Revenue | Line Net Amount 200,00 | |

| Tax Due | Tax Amount 32,40 |

Results

This completes the creation and processing of an Early Payment Discount. As a result:

- customer receivable amount has been accounted by taking into account the early payment discount

- early payment discount has been accounted separately