Cost Adjustment

| Back to Warehouse Management |

Contents

Introduction

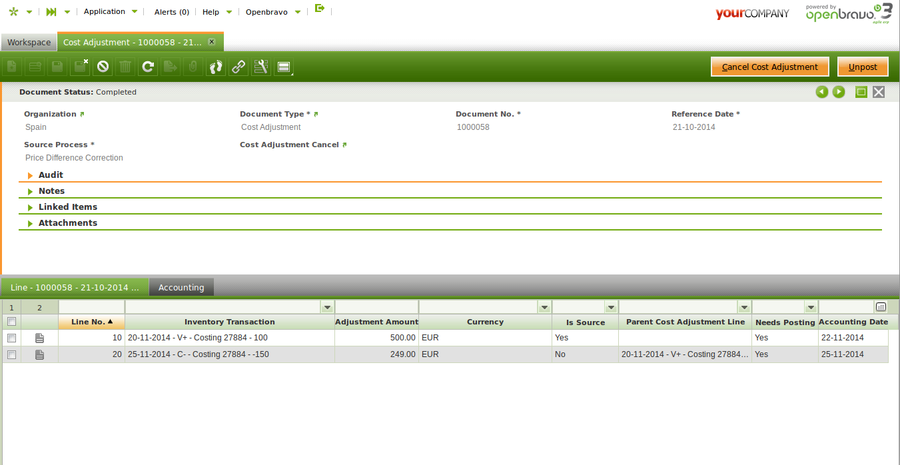

Cost Adjustment window allows to review product transaction's cost adjustments caused by changes in purchase prices, landed cost allocation or manual/negative cost corrections.

Template:ManualDoc:W1688A758BDA04C88A5C1D370EB979C53

Header

Cost adjustment documents are automatically created by either the "Costing Background" Process or the "Price Correction Background" process as applicable, depending on the source of the adjustment.

Once automatically created can be reviewed in this window.

Some relevant fields to note are:

- Document Type: this is the "Cost Adjustment" document type.

- Reference Date: this is the date when the cost adjustment is created

- Source Process: the options available are:

- Backdated Transaction

- Landed Cost

- Manual Cost Correction

- Negative Stock Correction

- Price Difference Correction

All of them are going to be explained in detail in the following sections.

Backdated Transaction

The source of this cost adjustment is a product transaction (i.e a goods receipt) that should have been booked in a previous date, but it was not.

As a consequence, the calculated cost of the transactions dated on a date after that given previous date need to be adjusted, same as the calculated "Average" cost of the product.

This cost adjustment source type do not apply to products valued at "Standard" cost.

The "Standard" cost of a product remains as it was defined because the cost of a "Standard" valued product is always the same, regardless the date when a transaction of that product is booked.

In case of a product valued at "Average" costing algorithm:

- a goods receipt dated on 06/01/2015 (Movement date) is booked dated on 06/01/2015 (Transaction date). This goods receipt once booked implies that the cost of the product (based on the corresponding purchase order price) is 105,00 €/unit.

- a goods shipment dated on 07/01/2015 (Movement Date) is also booked in Openbravo dated on 07/01/2015 (Transaction Date). This goods shipment once booked implies that the cost of the product sold is 105,00 €/unit

- later on a goods receipt of the same product dated on 02/01/2015 (Movement date) is booked in Openbravo dated on 07/01/2015 (Transaction date). Once booked this goods receipt implies that the cost of the product (based on the corresponding purchase order price) is 100.00, starting from 02/01/2015

- This last receipt with movement date 02/01/2015 is the source of a backdated transaction cost adjustment that adjust the cost of the product sold dated on 07/01/2015 from 105,00 €/unit to 102,50 €/unit, besides that the calculated average cost changes from 105,00 to 102,50 starting from 06/01/2015

Transactions that should have been booked in a previous date lead to the creation of "Backdated Transaction" cost adjustments.

A header and line(s) in the Cost Adjustment window are automatically created with the corresponding adjustments.

This adjustment type changes the "Unit Cost" of the product's transactions as well as the "Total Cost" and therefore the "Average" cost of the product.

Backdated transaction cost adjustments are created by:

- either running "Fix Backdated Transactions" process in existing costing rules

- or by checking "Backdated Transactions Fixed" check-box while creating a new costing rule.

Both ways, it is possible to enter a "Fix Backdated From" date which should not be part of a closed period.

Once Fix Backdated Transaction process is enabled in the corresponding costing rule, backdated transaction cost adjustments are automatically calculated by the Costing background process if applicable.

Backdated Adjustments Posting

A backdated cost adjustment can be post to the ledger in this window.

In our example above, the last receipt with movement date 02/01/2015 is the source of a backdated transaction cost adjustment that adjust the cost of the product sold from 105,00 €/unit to 102,50 €/unit

That adjustment can be post to the ledger. Posting will look as shown below:

| Account | Debit | Credit |

| Product Asset | Adjustment amount | |

| Cost of Goods Sold | Adjustment amount |

Landed Cost

The source of this cost adjustment is booking additional costs that need to be distributed and therefore allocated as additional product costs.

Landed cost are cost such as shipping, insurance, customs charges and other costs needed to place the product in the organization's warehouse.

Landed cost adjustments change the calculated cost of receipt transactions by changing its "Total Cost", same way the "Average" cost of the product involved also changes.

The "Unit Cost" of the receipt transaction does not change as this type of adjustments is not a unit cost adjustment but an extra cost.

This cost adjustment source type do not apply to products valued at "Standard" cost, in the sense that:

- whenever a landed cost is added to a product valued at standard cost, no cost adjustment is created but the "Variance" between the "standard" cost defined for the product and its "actual" cost is posted to a "Landed Cost Variance" account, so it can be later on analysed.

For instance:

- a purchase order containing a product is booked. After that the corresponding goods receipt and purchase invoice of the product are booked and posted to the ledger.

- Later on a purchase invoice including additional costs such as transportation cost and custom charges is booked and post to the ledger

- Landed Cost window allows to allocate the transportation costs and custom charges to the goods receipt, landed cost which are also matched to the invoice already booked.

There is no need to run any specific background process or enable any preferences to get a "Landed Cost" cost adjustment.

"Landed Cost" cost adjustments are created after processing the corresponding landed cost document in the Landed Cost window, or after processing landed cost matching

A header and line(s) in the Cost Adjustment window of this cost adjustment type is automatically created with the corresponding adjustment.

As already mentioned, landed cost adjustment does not change the "Unit Cost" of product's transactions but its "Total Cost", same way as the "Average" cost of the product. This means that:

- the unit cost of each transaction is the original one (price * units)

- and the total cost of each transaction includes the adjustments needed to get the desired product average cost.

Landed Cost Adjustments Posting

Landed cost adjustments can be post to the ledger in the Landed Cost window, whenever those adjustments have been created for products included in a Goods Receipt transaction.

- In this case, Goods Receipt transaction is the source of the adjustment.

Moreover, landed cost adjustments can also be created for products included in a Goods Shipment transaction.

- In this case, Goods Shipment transaction is not the source of the adjustment but the Goods Receipt.

- In this case landed cost adjustments need to be posted in the Cost Adjustment window.

Manual Cost Correction

The source of this cost adjustment is a manual change of the cost of a specific product transaction.

This adjustment type only applies to product transactions valued at "Average" cost. It make not sense to manually change the cost of a transaction valued at "Standard" cost.

For instance:

- a goods movement between warehouses needs to be adjusted, therefore "movement from" transaction cost is changed (increased) manually by the end-user

- above change implies that the cost of the "movement to" transaction needs also to be changed (increased), therefore the corresponding "Manual Cost Correction" cost adjustment is created.

There is no need to run any specific background process or enable any preference to get a "Manual Cost Correction" cost adjustment.

"Manual Cost Correction" cost adjustments are created after changing the cost of a product transaction in the Product window, "Transactions" tab, by using "Manual Cost Adjustment" process button.

A header and line(s) in the Cost Adjustment window of this cost adjustment type is automatically created with the corresponding adjustment.

This adjustment type changes the "Total Cost" of the product transaction, however product transaction "Unit Cost" can either be changed or not, depending on what the end-user wants to get.

There is a check-box named "Unit Cost" that it shown whenever "Incremental" check-box is selected:

- If the user does not select the check-box "Incremental" that means booking a new total cost of the transaction which will remain as "Permanent". That means it will not be changed anymore.

- If the user does select the check-box "Incremental" that means booking an additional cost to allocate to the total cost of the transaction. Besides, this additional cost can either be part of the unit cost (Unit Cost check-box = Yes) of the transaction or not (Unit Cost check-box = No). Last case means an extra cost such as a landed cost.

For additional information please review Manual Cost Adjustment article.

Manual Cost Correction Adjustment Posting

This type of adjustment can be post to the ledger in this window.

In our example above, "movement from" transaction cost is changed (increased) manually by the end-user, therefore the cost of the "movement to" transaction needs also to be changed (increased).

That adjustment can be post to the ledger. Posting will look as shown below:

"Movement From" transaction adjustment:

| Account | Debit | Credit |

| Warehouse Differences | Adjustment amount of "Movement From" transaction | |

| Product Asset | Adjustment amount of "Movement To" transaction |

"Movement To" transaction adjustment:

| Account | Debit | Credit |

| Product Asset | Adjustment amount of "Movement To" transaction | |

| Warehouse Differences | Adjustment amount of "Movement To" transaction |

Negative Stock Correction

The source of this cost adjustment is booking a transaction, i.e a goods shipment, that turns the stock of a product into a negative quantity. This type of correction is only implemented for "Average" costing calculation.

At the time of booking a new receipt of that item, regardless if that receipt turns item stock to a positive/negative/zero value, a negative cost correction adjustment is created and related to that new receipt, to get that the stock remaining of that product is valued at the last purchase price, in the case of "Average" cost calculation.

For instance:

- a purchase order of 100 units is booked at a given purchase price

- after that goods are receipt and the cost of goods is calculated based on the order purchase price

- then a shipment of 100 units is booked

- and another shipment of 5 units is booked afterwards, leading to a negative stock of the product.

A negative stock correction cost adjustment will be created whenever an incoming transaction for the product such as a goods receipt is booked. That adjustment will be allocated to the goods receipt.

This adjustment type does not change the "Unit Cost" of the receipt but its "Total Cost" same way as the "Average" cost of the product involved. This means that:

- the unit cost of each transaction is the original cost (price * units)

- and the the total cost of each transaction includes the adjustments needed to get the desired average cost.

There are two actions to take to get negative stock correction cost adjustments:

- To configure Enable Negative Stock Corrections preference with Value=Y in Preference window

- To schedule Costing Background process in Process Request window

Negative Stock Correction Adjustment Posting

This type of adjustment can be post to the ledger in this window.

In our example above, an adjustment of this type is created whenever a new incoming transaction such as a goods receipt is booked for the product having a negative stock.

That adjustment can be post to the ledger. Posting will look as shown below in the case of a negative adjustment amount, otherwise in case of a positive adjustment amount:

| Account | Debit | Credit |

| Warehouse Differences | Adjustment amount | |

| Product Asset | Adjustment amount |

Price Difference Correction

The source of this cost adjustment is a change in either the purchase price of an order or the purchase price of an invoice after receiving the goods.

Price Difference Correction is launched only for Transactions of Type Receipt. Other Transactions, such as Return Material our Outgoing Transactions are not taken into account, since they should not modify the Average Cost due to a Price Correction.

Those goods were received at a price that has changed, therefore the calculated cost of the receipt needs to be adjusted, same as the calculated "Average" cost of the product.

"Standard" cost would remain as it was set.

For instance:

- a purchase order is booked for a product at a given purchase price

- after that the product is receipt and the "Average" cost of the product is calculated based on the corresponding order purchase price.

- a goods shipment of that product is booked, therefore that output transaction gets the calculated "Average" cost of the product.

- then a purchase invoice is received and booked for the product at a higher price than the order purchase price

- a price difference correction cost adjustments needs to be created to adjust the Goods Receipt and then affect the Goods Shipment transaction based on the new calculated Average Cost of the product.

Changes in purchase price leads to the creation of "Price Difference Correction" cost adjustments.

A header and line(s) in the Cost Adjustment window of this cost adjustment type is automatically created with the corresponding adjustment.

This adjustment type changes the "Unit Cost" and the "Total Cost" of the transactions, same as the "Average" cost of products.

"Price Difference" correction adjustments can be performed "automatically" or "manually":

- to get that Openbravo automatically performs price difference correction cost adjustments, it is necessary to activate and schedule the Price Correction Background Process

- to get that the user can manually perform price difference correction cost adjustments, it is necessary to manually run the "Process Price Difference Adjustment"

As shown in the image below, this process allows to select the Organization for which this process needs to be run, enter a given movement date and select a product or set of products for which price difference correction cost adjustments would need to be create.

Additionally, the Costing Background Process can also create price difference correction cost adjustments, only if:

- the "Enable Automatic Price Difference Corrections property preference is set to "Y"

- and the Costing Background Process is run after booking the corresponding Purchase order, Goods Receipt and Purchase Invoice including the price difference.

Price Difference Correction Adjustment Posting

This type of adjustment can be post to the ledger in this window.

In our example above, a change in the purchase order price (increase) implies that both the calculated cost of the "Goods Receipt" and the calculated cost of the "Goods Shipment" need to be adjusted same as the "Average" cost of the product.

That adjustment can be post to the ledger. Posting will look as shown below :

Goods Receipt adjustment

| Account | Debit | Credit |

| Product Asset | Goods Receipt Adjustment amount | |

| Invoice Price Difference | Goods Receipt Adjustment amount |

Goods Shipment adjustment

| Account | Debit | Credit |

| Cost of Goods Sold | Goods Shipment Adjustment amount | |

| Product Asset | Goods Shipment Adjustment amount |

Line

A cost adjustment document can have as many adjustment lines as products included in the receipts to which landed cost have been allocated.

Template:ManualDoc:T06DCB72BB6D24F82BCDA5FFF8EA0425C

Accounting

This tab provides Cost Adjustment accounting information.

Template:ManualDoc:TEE01CF71A3D741E8B2B7204ADCBBF7A8

Full list of Cost Adjustment window fields and their descriptions is available in the Cost Adjustment Screen Reference.

| Back to Warehouse Management |