Template:ManualDoc:W4A35B1C57B4243F4A1E42D882C8DDA3D

Doubtful debts are those debts which the company is unlikely to be able to collect. Moreover a doubtful debt becomes a bad debt when there is no longer any doubt that the debt is noncollectable, therefore:

- Doubtful Debt: receivable that might become a bad debt at some point in the future.

- Bad debt: receivable that has been clearly identified as not being collectible.

Doubtful debts are useful in order to make provisions for possible looses beforehand.

User Story

The following example illustrates how Openbravo manages Doubtful Debts posting to the ledger.

The Client Healthy Food Supermarkets, Co. whom owes the company 1,000 EUR is going through a difficult situation, hence it's debt is considered doubtful.

| Account | Debit | Credit |

| Doubtful Debt Account | 1000 | |

| Customer Receivables | 1000 |

| Account | Debit | Credit |

| Bad Debt Expense Account | 1000 | |

| Allowance For Doubtful Debt Account | 1000 |

The Client Healthy Food Supermarkets, Co. makes a Payment of 350 EUR:

| Account | Debit | Credit |

| In Transint Payment IN Account | 350 | |

| Doubtful Debt Account | 350 |

| Account | Debit | Credit |

| Allowance For Doubtful Debt Account | 350 | |

| Bad Debt Revenue Account | 350 |

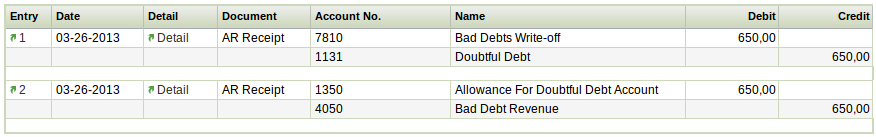

Later, the client becomes bankrupt, so it's debt is considered bad:

| Account | Debit | Credit |

| Write-off | 650 | |

| Doubtful Debt Account | 650 |

| Account | Debit | Credit |

| Allowance For Doubtful Debt Account | 650 | |

| Bad Debt Revenue Account | 650 |

Configuration

Before start working with Doubtful Debt some previous configuration steps are required:

- To configure Accounting for Doubtful Debts. The accounts that need to be configured are:

- Doubtful Debt Account

- Bad Debt Expense Account

- Bad Debt Revenue Account

- and Allowance for Bad Debts Account.

- To create a Preference in order to be able to see the amount of a debt that has been classified as doubtful when receiving a Payment.

This preference must be defined for the Client and the Organization that needs to see it.

This preference is an Attribute 'Doubtful_Debt_Visibility' which Value needs to be 'Y' - To create a Document Type for Doubtful Debts.

This step is not a must, since there is already a Standard Document Type defined for Doubtful Debts.

Example

This example is based on the previous User Story, using the demo data provided by Openbravo.

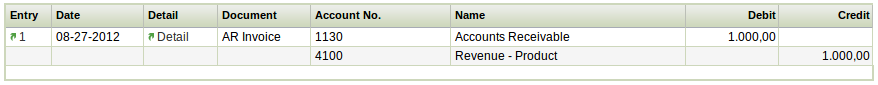

The Customer Healthy Food Supermarkets, Co. has an Invoice of 1.000,00 USD pending to be collected, and this is it's Journal Entry, created when Posting the Invoice

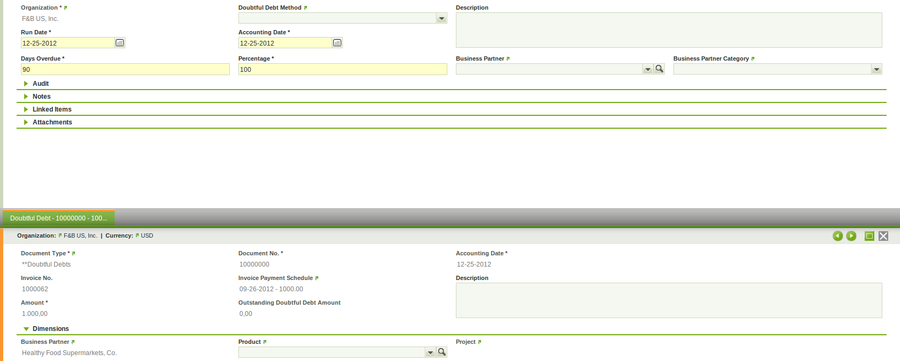

After three months without collecting the pending debts from this Customer, the debt from the previous Invoice is considered Doubtful, henceforth a Doubtful Debt Run needs to be created and processed.

As shown in the image below, the "Run Date" and the "Accounting Date" are the same, that is 90 days after the Invoice Date, as well as the Days Overdue.

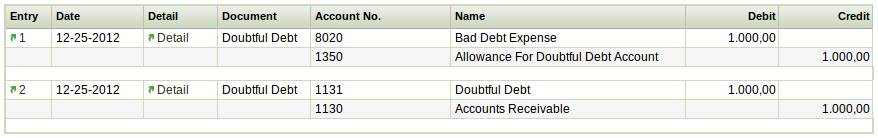

Back to the Doubtful Debt Window, the doubtful debt created and processed in the Doubtful Debt Run can be posted. Two entries are generated in the Journal.

One to reclassify the debt from Accounts Receivable to Doubtful Debt and the other one to represent the provision for the Doubtful Debt.

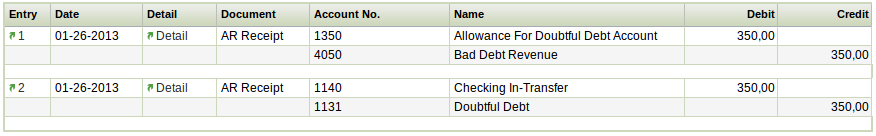

A couple of days after, the Customer makes a Payment of 350,00 USD against the previous Invoice, and the Posting of the Payment creates this entries in the Journal.

One entry that balances the Doubtful Debt and the Checking In-Transfer Account, and the other entry that decreases the Doubtful Debt provision generated previously.

Three months later the Customer becomes bankrupt, therefore it won't be possible to recover it's debt any longer. A Payment is made to write off the amount remaining.

That action creates another two entries in the Journal.