Template:ManualDoc:T324

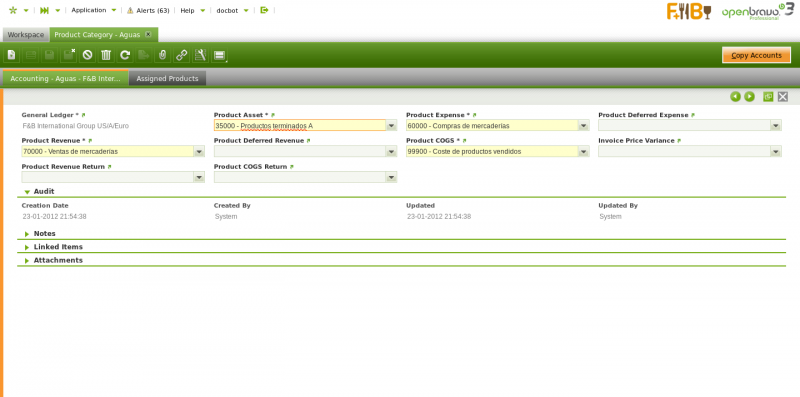

There is a set of product related accounts which needs to be properly setup for the organization's general ledger configuration.

The "Copy Accounts" process of the Defaults tab of the General Ledger Configuration screen allows to automatically populate at least the mandatory ones shown in the image above.

The accounts automatically defaulted by Openbravo can always be changed if required.

The whole list of product related accounts is:

- Product Assets: this field stores the default account to be used to record inventory transactions such as:

- This account is typically an asset account

- Product Expense: this field stores the default account to be used to record product purchase expenses.

This account is typically an expense account. - Product Deferred Expense: this field stores the default account to be used to record deferred expenses.

This account is typically an asset account. - Product Revenue: this field stores the default account to be used to record product sales revenues.

This account is typically a revenue account. - Product Deferred Revenue: this field stores the default account to be used to record deferred revenues.

This account is typically a liability account. - Product COGS: this field stores the default account to be used to record the cost of the goods sold.

This account is typically an expense account. - Product Revenue Return: this field stores the default account to be used to record sales returns .

This account is typically a revenue account. - Product COGS Return: this field stores the default account to be used to record return material receipts.

This account is typically an expense account. - Invoice Price Variance: this field stores the default account to be used to record price differences between posted Goods Receipts and booked Purchase Invoices.

This account is typically an asset account.

The "Copy Accounts" action button allows to copy the accounts defaulted in this window to the Product Accounting tab.