Template:ManualDoc:T161

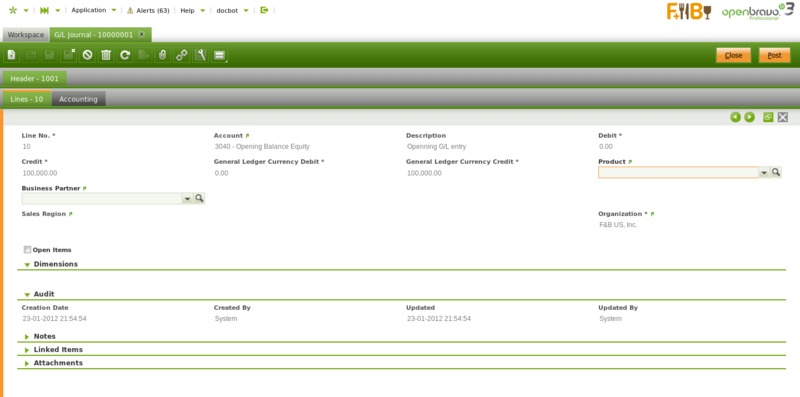

Each journal line represents an entry in the ledger.

Each journal line needs to have an Account of the organization's general ledger that is the financial mandatory dimension and either a debit or a credit amount.

It is possible to enter other accounting dimensions such as "Product", "Sales Region" or "Campaign" if centrally maintained in the Client and/or if maintained in the Dimension tab of the organization's general ledger configuration.

Once all the journal lines have been entered the total credit amount needs to be equal to the total debit amount therefore the G/L Journal is Balanced and can be post to the ledger.

G/L Item payments creation

It is possible to create:

- a "Payment Made" which will be automatically populated as a payment in the Payment Out window upon completion of the G/L Journal.

- or a "Payment Received" which will be automatically populated as a payment in the Payment In window upon completion of the G/L Journal

by selecting the "Open Items" checkbox in the journal line from which the payment needs to be created:

- If the line selected has a "Debit" amount that would imply the creation of a Payment Received.

- If the line selected has a "Credit" amount that would imply the creation of a Payment Made.

Once done below payment related information needs to be filled in:

- the Financial Account where the money is going to be taken from or where the money is going to be deposited in

- a Payment Method linked to the financial account selected.

The payment method selected will drive the way the payment received/made is going to behave within the accounts payables/receivables cycle. - a G/L Item to be used while posting the payment made/received.

The G/L Item account should be the one as the account selected in the line from where the payment needs to be created. Payment posting would cancel the balance of that account. For additional information please review the How to manage payroll accounting and payment article. - a Payment Date

- and a Business Partner which should be configured as a "Vendor" while making a payment (from the "Credit" amount line), or as a "Customer" while receiving a payment (from the "Debit" amount line).

Even in the case of accounting an employee payroll, the employee needs to be set as a "Vendor".

Upon completion of the G/L Journal a payment made/received is created and filled in the "Payment" field of the line where the payment related information above described was entered.