Difference between revisions of "Financial Management"

(→Receivables and Payables) |

|||

| Line 49: | Line 49: | ||

There are 3 Openbravo accounting concepts which need to be explained before describing the basic accounting configuration: | There are 3 Openbravo accounting concepts which need to be explained before describing the basic accounting configuration: | ||

| − | == Receivables and Payables == | + | == '''Receivables and Payables''' == |

Revision as of 17:59, 25 October 2018

| Back to User Guide |

Contents

Introduction

Openbravo automatically generates an accounting representation of all the transactions within the enterprise that have an economic relevance. Accounting is the system of tracking the assets, the debts, the income and the expenses of a business.

In Openbravo, most of the accounting entries are automatically created while posting documents such as:

- Goods Receipts and Purchase Invoices in the Procurement Management business area

- Goods Shipments and Sales Invoices in the Sales Management business area.

Accounting entries do not directly related to documents managed within a given application area can be created and posted in a G/L Journal. For instance a provision for stock depreciation accounting entry.

There are three ways of accounting in Openbravo:

- To manually post each document by using the process button "Post".

The process button "Post" can be found in the window used to create a given document. For instance a purchase invoice is created and therefore could be posted in the Purchase Invoice window.- This button is shown for accounting users if the Attribute "ShowAcct" is visible for them. This configuration is enabled through a Preference.

- To manually post all the documents/transactions related to a given database table for instance the table "Invoices", by using the process GL posting by DB Tables

- or to automatically post accounting transactions of any type by scheduling the "Accounting Server Process" in the Process Request window.

Accounting activities such as:

- creating and opening of the accounting periods

- entering and posting accounting transactions

- managing payables and receivables accounts as well as the asset depreciation

- reviewing and submitting financial and tax reports to the official authorities

- and closing the accounting year

are performed within the Financial Management application area.

Finally Openbravo has an integrated accounting system that combines general accounting and analytical accounting:

- General accounting aims to primary exploit dimensions such as "Account" (or "Subaccount" in Openbravo terms)

- Analytical accounting aims to exploit other dimensions such as "Cost Center" or "Campaign" to get a slightly different but also rich financial information.

In other words, Openbravo allows to post transactions to the ledger which can include different dimensions:

- Those dimensions can be centrally maintained in the Client therefore are available to all the organizations within that Client. Moreover Organizations of that Client can also have additional dimensions configured separately in its General Ledger Configuration.

Those dimensions are then available just for that Organization. - On the other hand, those dimensions can not be centrally maintained in the Client but independently maintained in the Organization's General Ledger Configuration.

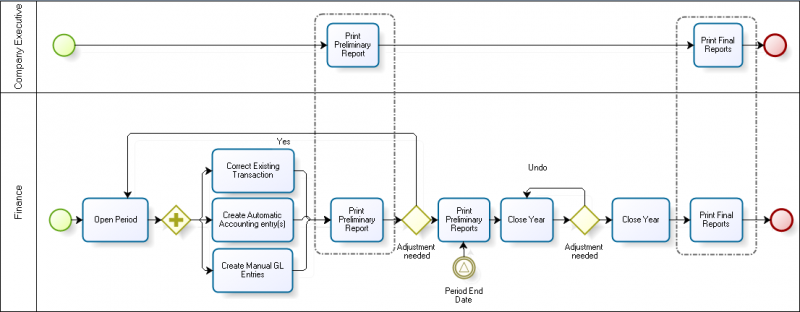

This application area covers the Period End Close to Financial Report business flow and the Payables and Receivables Management business flow.

Period End Close to Financial Report

Period End Close to Financial Report business flow manages the open and close of periods.

Configuration

This section details the basic and not that basic accounting configuration needed prior to the execution of the "Period End Close to Financial Report" business flow.

Basic Configuration There are 3 Openbravo accounting concepts which need to be explained before describing the basic accounting configuration:

Receivables and Payables

Transactions

- Purchase Invoice Payment Plan

- Payment Out

- Payment Proposal

- Sales Invoice Payment Plan

- Payment In

- Financial Account

- Payment Execution

- Tax Payment

- Doubtful Debt

- Doubtful Debt Run

Analysis Tools

- Cashflow Forecast Report

- Receivables Aging Schedule

- Payables Aging Schedule

- Payment Report

- Payment Run

Setup

Accounting

Transactions

- Simple G/L Journal

- G/L Journal

- End Year Close

- GL Posting by DB Tables

- Budget

- Create Budget Reports in Excel

- Not Posted Transaction Report

- Reset Accounting

Analysis Tools

- Accounting Transaction Details

- Balance sheet and P&L structure

- Trial Balance

- General Ledger Report

- Journal Entries Report

- Customer Statement

Setup

- Open/Close Period Control

- Period Control Log

- Account Tree

- General Ledger Configuration

- Fiscal Calendar

- Account Combination

- G/L Item

- G/L Category

- Document Type

- Document Sequence

- Tax Category

- Business Partner Tax Category

- Tax Rate

- Cost Center

- ABC Activity

- Balance sheet and P&L structure Setup

Assets

Analysis Tools

Advanced

- Matching Algorithm

- Bank File Format

- Execution Process

- User Defined Accounting Report

- Create Tax Report

- User Defined Accounting Report Setup

- Tax Report Setup

- Accounting Process

- Accounting templates

| Back to User Guide |