Difference between revisions of "Financial Management"

(→Execution) |

(→Configuration) |

||

| Line 44: | Line 44: | ||

=== '''Configuration''' === | === '''Configuration''' === | ||

| + | |||

This section details the basic and not that basic accounting configuration needed prior to the execution of the "Period End Close to Financial Report" business flow. | This section details the basic and not that basic accounting configuration needed prior to the execution of the "Period End Close to Financial Report" business flow. | ||

| − | '''Basic Configuration''' | + | ==== '''Basic Configuration''' ==== |

| + | |||

There are 3 Openbravo accounting concepts which need to be explained before describing the basic accounting configuration: | There are 3 Openbravo accounting concepts which need to be explained before describing the basic accounting configuration: | ||

| + | * Fiscal Calendar. | ||

| + | A fiscal calendar in Openbravo is the year and the periods, normally months, when financial transactions and journal entries are posted to the ledger. | ||

| + | |||

| + | * Account Tree | ||

| + | An account tree is the way Openbravo captures the "Chart of Accounts" (CoA) of an Organization. | ||

| + | The Chart of Accounts is a list of all the accounts used in an organization's general ledger. | ||

| + | Accounts such as balance sheet accounts (assets, liabilities and owner's equity) and income statement accounts (revenues, expenses, gains and losses). | ||

| + | It is important to remark that in Openbravo, the financial reports such as the Balance Sheet and the Income Statement are produced based upon the Chart of Accounts structure. | ||

| + | |||

| + | * General Ledger configuration. | ||

| + | The general ledger configuration captures the accounting rules to use while posting the organization's financial transactions to the ledger. Accounting rules such as the "Currency" and the "Chart of Accounts" among others. | ||

=== '''Advanced Configuration''' === | === '''Advanced Configuration''' === | ||

Revision as of 18:27, 25 October 2018

| Back to User Guide |

Contents

Introduction

Openbravo automatically generates an accounting representation of all the transactions within the enterprise that have an economic relevance. Accounting is the system of tracking the assets, the debts, the income and the expenses of a business.

In Openbravo, most of the accounting entries are automatically created while posting documents such as:

- Goods Receipts and Purchase Invoices in the Procurement Management business area

- Goods Shipments and Sales Invoices in the Sales Management business area.

Accounting entries do not directly related to documents managed within a given application area can be created and posted in a G/L Journal. For instance a provision for stock depreciation accounting entry.

There are three ways of accounting in Openbravo:

- To manually post each document by using the process button "Post".

The process button "Post" can be found in the window used to create a given document. For instance a purchase invoice is created and therefore could be posted in the Purchase Invoice window.- This button is shown for accounting users if the Attribute "ShowAcct" is visible for them. This configuration is enabled through a Preference.

- To manually post all the documents/transactions related to a given database table for instance the table "Invoices", by using the process GL posting by DB Tables

- or to automatically post accounting transactions of any type by scheduling the "Accounting Server Process" in the Process Request window.

Accounting activities such as:

- creating and opening of the accounting periods

- entering and posting accounting transactions

- managing payables and receivables accounts as well as the asset depreciation

- reviewing and submitting financial and tax reports to the official authorities

- and closing the accounting year

are performed within the Financial Management application area.

Finally Openbravo has an integrated accounting system that combines general accounting and analytical accounting:

- General accounting aims to primary exploit dimensions such as "Account" (or "Subaccount" in Openbravo terms)

- Analytical accounting aims to exploit other dimensions such as "Cost Center" or "Campaign" to get a slightly different but also rich financial information.

In other words, Openbravo allows to post transactions to the ledger which can include different dimensions:

- Those dimensions can be centrally maintained in the Client therefore are available to all the organizations within that Client. Moreover Organizations of that Client can also have additional dimensions configured separately in its General Ledger Configuration.

Those dimensions are then available just for that Organization. - On the other hand, those dimensions can not be centrally maintained in the Client but independently maintained in the Organization's General Ledger Configuration.

This application area covers the Period End Close to Financial Report business flow and the Payables and Receivables Management business flow.

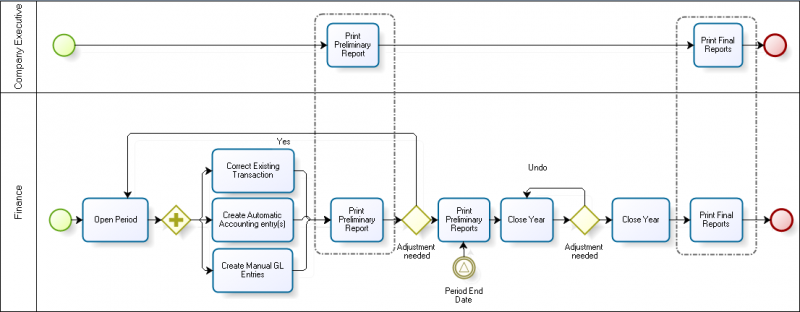

Period End Close to Financial Report

Period End Close to Financial Report business flow manages the open and close of periods.

Configuration

This section details the basic and not that basic accounting configuration needed prior to the execution of the "Period End Close to Financial Report" business flow.

Basic Configuration

There are 3 Openbravo accounting concepts which need to be explained before describing the basic accounting configuration:

- Fiscal Calendar.

A fiscal calendar in Openbravo is the year and the periods, normally months, when financial transactions and journal entries are posted to the ledger.

- Account Tree

An account tree is the way Openbravo captures the "Chart of Accounts" (CoA) of an Organization. The Chart of Accounts is a list of all the accounts used in an organization's general ledger. Accounts such as balance sheet accounts (assets, liabilities and owner's equity) and income statement accounts (revenues, expenses, gains and losses). It is important to remark that in Openbravo, the financial reports such as the Balance Sheet and the Income Statement are produced based upon the Chart of Accounts structure.

- General Ledger configuration.

The general ledger configuration captures the accounting rules to use while posting the organization's financial transactions to the ledger. Accounting rules such as the "Currency" and the "Chart of Accounts" among others.

Advanced Configuration

As already mentioned there is an additional accounting configuration which might be needed regardless of whether a localization pack is installed or not.

- The creation of the G/L Items.

A G/L item is an “alias” used in place of a sub-account number. A G/L Item can be used to post transactions related to invoices and payments. G/L items are used to account for financial obligations that are not ordinarily invoiced and other special procurement items which are invoiced but for which no ordinary master data (such as a Product) are maintained.

As a side note Openbravo contains pre-seeded Document Types:

- Each document type in Openbravo refers to a business transaction such as a purchase invoice or a sales order.

- The document types allow you to create specific printed formats for business documents and allow you to define sequence numbers for their use.

Execution

Overall the Period End Close to Financial Report business flow can be split into the following steps once the accounting period has been opened:

- the opening of the accounting

- the review of the accounting transactions

- the creation of accounting transactions and G/L item payments

- the printing of the Trial Balance

- the adjustments required prior to the income calculation

- the adjustments require prior to the closing of the accounting year

- the printing of the preliminary Income Statement and Balance Sheet

- the closing of the accounting year

- and the printing of the final Income Statement and Balance Sheet

Opening of the accounting

This very first step implies to initialize the balance of the ledger accounts and the financial accounts or banks. The way to do that in Openbravo is:

- The ledger accounts balance can be initialized by using a G/L Journal set us "Opening", therefore that ledger entry is set as the "Opening Ledger Entry".

A journal line can be created for each account and its opening balance, once done the G/L Journal will validate that the Total Debit of all the entries equals to the Total Credit. - The financial accounts balance can be initialized in the Financial Account window, in the "Initial Balance" field, therefore the corresponding financial account/s or banks needs to be previously created.

To learn more about this topic, please review the How to initialize financial balances in Openbravo article.

Review of the accounting transactions

As already mentioned in Openbravo most of the accounting entries are automatically created while posting documents such as a purchase invoice or a sales invoice. For instance the accounting of a purchase invoice will take:

- the expense account setup for the product being purchased in the Accounting tab of the "Product" window

- the vendor liability account setup for the vendor in the Vendor Accounting tab of the "Business Partner" window

- and the tax credit account setup in the Accounting tab of the "Tax Rate" window.

Creation of accounting transactions and G/L item payments

As already mentioned accounting entries do not related to documents managed within a given application area can be created and post to the ledger by using a G/L Journal.

A G/L Journal can also be used to make and/or receive payments do not related to orders/invoices but to G/L items. G/L items payments are also managed within the Payables and Receivables management area.

Printing of the Trial Balance to check that "Debit=Credit

The Trial Balance is a list indicating the balances of every single general ledger account at a given point in time. The purpose of the trial balance is to check that debits are equal to credits. If debits do not equal credits that means that an erroneous journal entry must have been posted.

Openbravo does not allow to post journal entries which do not balance. A G/L Journal can only be posted if Debit equals Credit, however there could be situations where while posting an invoice rounding differences drive that debit do not exactly equal credit. In this situations the difference is posted in a specific suspense account. Suspense accounts are configured in the General Ledger configuration.

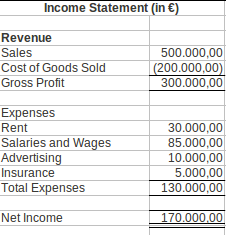

Adjustments required prior to the income calculation

An organization's income statement shows the organization's financial performance over a period of time (usually one year) as the difference between:

- the organization's revenue

- and the organization's expenses

An Income Statement can look like:

Receivables and Payables

Transactions

- Purchase Invoice Payment Plan

- Payment Out

- Payment Proposal

- Sales Invoice Payment Plan

- Payment In

- Financial Account

- Payment Execution

- Tax Payment

- Doubtful Debt

- Doubtful Debt Run

Analysis Tools

- Cashflow Forecast Report

- Receivables Aging Schedule

- Payables Aging Schedule

- Payment Report

- Payment Run

Setup

Accounting

Transactions

- Simple G/L Journal

- G/L Journal

- End Year Close

- GL Posting by DB Tables

- Budget

- Create Budget Reports in Excel

- Not Posted Transaction Report

- Reset Accounting

Analysis Tools

- Accounting Transaction Details

- Balance sheet and P&L structure

- Trial Balance

- General Ledger Report

- Journal Entries Report

- Customer Statement

Setup

- Open/Close Period Control

- Period Control Log

- Account Tree

- General Ledger Configuration

- Fiscal Calendar

- Account Combination

- G/L Item

- G/L Category

- Document Type

- Document Sequence

- Tax Category

- Business Partner Tax Category

- Tax Rate

- Cost Center

- ABC Activity

- Balance sheet and P&L structure Setup

Assets

Analysis Tools

Advanced

- Matching Algorithm

- Bank File Format

- Execution Process

- User Defined Accounting Report

- Create Tax Report

- User Defined Accounting Report Setup

- Tax Report Setup

- Accounting Process

- Accounting templates

| Back to User Guide |